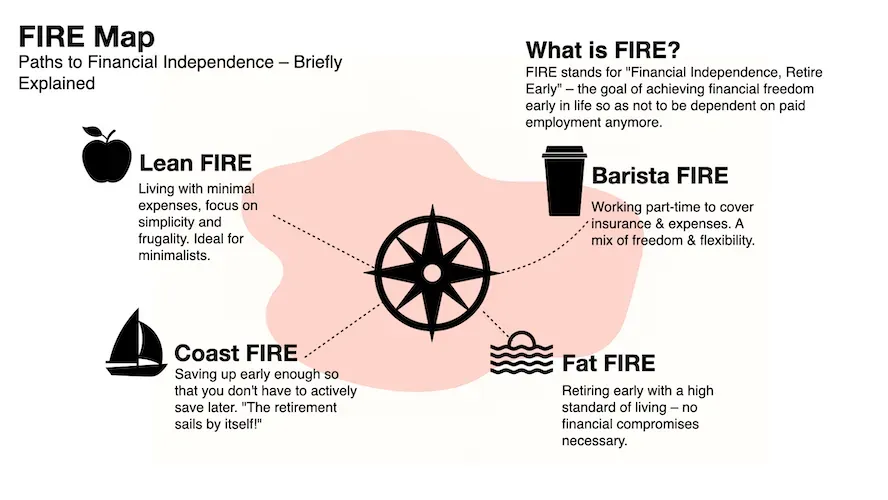

Variants of the FIRE movement: An overview

FIRE stands for Financial Independence, Retire Early. It is not a rigid formula, but rather a range of strategies for achieving financial independence — from very lean to very comfortable. What they all have in common are high savings rates, consistent investing, and clear spending goals. The choice of variant depends primarily on your desired lifestyle and risk tolerance.

We have written down our view on the topic of “FIRE in Germany” here, with a perspective that may still be somewhat unusual for you, but which we hope will inspire you to think.

Lean FIRE: Minimalism as a path to freedom

Lean FIRE is aimed at people who are prepared to lead a minimalist and very frugal lifestyle in retirement. The goal is to get by with as little annual expenditure as possible, often well below the national average.

Concept: Extremely high savings rates of over 50% of income and a consistent reduction in spending allow the capital required for retirement to be achieved more quickly. The focus is on basic needs and doing without consumer goods.

Approach: Followers of Lean FIRE often practice a frugal lifestyle years before retirement. Strategies include living in low-cost regions, minimizing housing and transportation costs, and general consumer restraint. The target capital is the lowest compared to other FIRE variants.

Fat FIRE: Enjoying prosperity in retirement

Fat FIRE is the direct opposite of Lean FIRE. Here, the goal is to achieve financial independence without having to give up a comfortable or even luxurious lifestyle.

Concept: The aim is to accumulate significantly higher retirement capital, enabling annual expenses well above average. This allows for continued travel, expensive hobbies, and a generous standard of living.

Approach: Achieving Fat FIRE usually requires high income, successful entrepreneurial activities, or very aggressive and profitable investment strategies. The savings rate is also high, but the accumulated wealth is sized to cover an expensive lifestyle.

Barista FIRE: The bridge to retirement

Barista FIRE is a hybrid form that allows you to leave your demanding full-time job earlier without having already achieved complete financial independence.

Concept: Your savings cover most of your living expenses, but not all of them. The remaining gap is filled by part-time income from a job that is usually less stressful. The name is derived from the idea of taking on a relaxed job as a barista, which often also offers social benefits such as health insurance.

Approach: Instead of saving until the full FIRE goal is achieved, the aim is to reach a point where investment income covers most of the expenses. This reduces financial pressure and allows for an earlier transition to a more satisfying or less demanding job.

Coast FIRE: Let compound interest do the work

Coast FIRE aims to reach a point where the capital already invested is sufficient to grow to the desired amount by the traditional retirement age through the effect of compound interest, without any further payments.

Concept: Once the “Coast FIRE” goal has been achieved, no further contributions need to be made to retirement savings. Current income only needs to cover current living expenses.

Approach: This strategy requires early and aggressive saving when you are young. Once the goal is achieved, there is a great deal of flexibility: you can reduce your working hours, switch to a less lucrative but more fulfilling career, or enjoy more free time, safe in the knowledge that your retirement is secure.

Conclusion

FIRE is not a competition, but a tool. Lean FIRE often gets you to independence faster, but requires minimalism in the long term. Fat FIRE takes longer, but rewards you with comfort and reserves. Barista FIRE offers a soft landing from full-time stress, and Coast FIRE gives you peace of mind that your retirement savings are already “on track.” If you want to achieve FIRE, choose the option that fits your values, risk appetite, and life situation—and stay flexible: lifestyle, income, and markets change, so your plan can too.